Nowadays, it is difficult to think of a major company that does not operate outside of its home country. In developed economies, business internationalisation has become the norm. Goldman Sachs estimates that 28% of S&P 500 revenues come from foreign markets. For firms, globalisation offers clear advantages: larger markets, cheaper inputs, access to talent, and faster innovation. Yet, in today’s volatile world, deciding where to operate has become just as critical as deciding what to sell. Business leaders are increasingly alert to the dangers of geopolitical risk. A recent PwC poll found that 41% of executives in Ireland view geopolitics as the top threat to their business. This perception is not unique to Ireland, but reflects a broader global trend. As trade tensions and wars reshape markets, demand for geopolitical risk analysis and market intelligence services is rising sharply.

To understand how companies are adapting, we interviewed Professor Thales Castro, CEO of CogniTrends, an American firm specialised in geopolitical analysis. Castro is also the Honorary Consul of Malta at Recife and a prominent scholar of international relations.

In our interview, Castro outlined how diplomacy, academia, and business intersect in the age of geopolitical uncertainty.

“Not long ago, geopolitics was seen as a matter for states and diplomats,” Castro recalls. “But today, private sector actors recognise that geopolitics and geoeconomics are crucial to their success.” This realisation led him to found CogniTrends, which provides tailored risk assessments for companies navigating volatile environments.

Geopolitical risk analysis around the world: what do clients want?

Castro describes his firm’s clientele as split between public and private actors, with American firms particularly focused on how macropolitical shifts affect foreign trade performance. U.S. corporations, he notes, are eager to understand the risks tied to market entry in Latin America. In this region, recent political changes, such as polarisation, the Venezuelan refugee crisis and the Guyana oil-driven economic transformation; have redrawn the playing field.

Moreover, Castro notes that demand depends strongly on firms’ sector of operation. He highlights that “oil and gas conglomerates depend heavily on political decisions abroad, not just in OPEC countries but beyond… Tech companies, meanwhile, are asking: how much risk tolerance can we accept in new markets?”

CogniTrends’ tools: OSINT and HUMINT

CogniTrends operates at the intersection of qualitative and quantitative methods, balancing open-source intelligence (OSINT) with human intelligence (HUMINT).

OSINT refers to the process of gathering and analysing information that is publicly available. Such method can be employed in multiple ways: from sentiment analysis to the monitoring of international economic and financial dynamics. OSINT gatherers may, for example, track vessel movements and track port activity to gain insights into patterns that might predict economic shifts in trade.

While open source data offers an immense large-scale power, according to Professor Castro, the competitive advantage of CogniTrends lies on human intelligence; employed by only a few other firms in the geopolitical risk analysis sector. HUMINT involves actors, observers, and players in the field who provide reporting and insights. Some techniques used within this method are interviews, espionage and liaisons. The use of human intelligence can provide in-depth insights that may not be available through other means. Nevertheless, it is important to evaluate whether the consulting firm offering this service respects the compliance norms required for this type of research.

The International Power Index (PI)

Castro’s team applies advanced statistical tools such as the Preventive International Market Assessment (PIMA) model, alongside his own International Power Index (PI). This is a framework first introduced in his 2012 book Teoria das Relações Internacionais (Theory of International Relations).

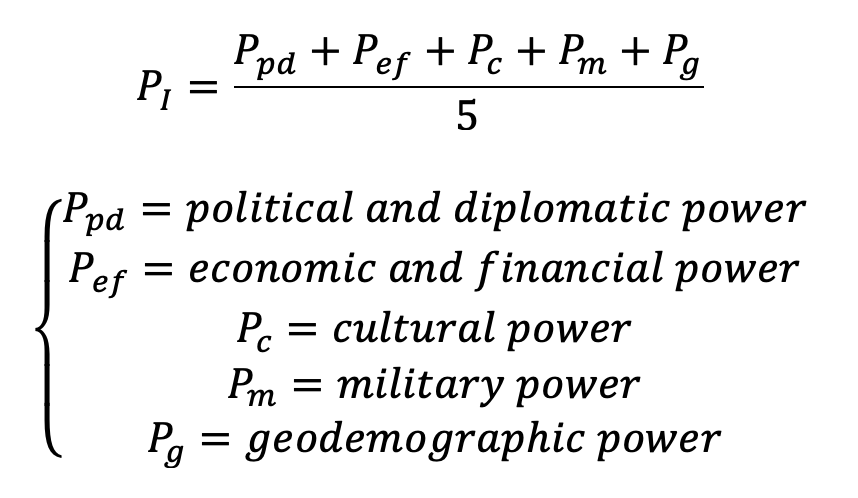

The International Power Index (PI) measures a state’s overall power by taking the arithmetic mean of five key dimensions: political and diplomatic power, economic and financial strength, cultural influence, military capacity, and geodemographic weight.

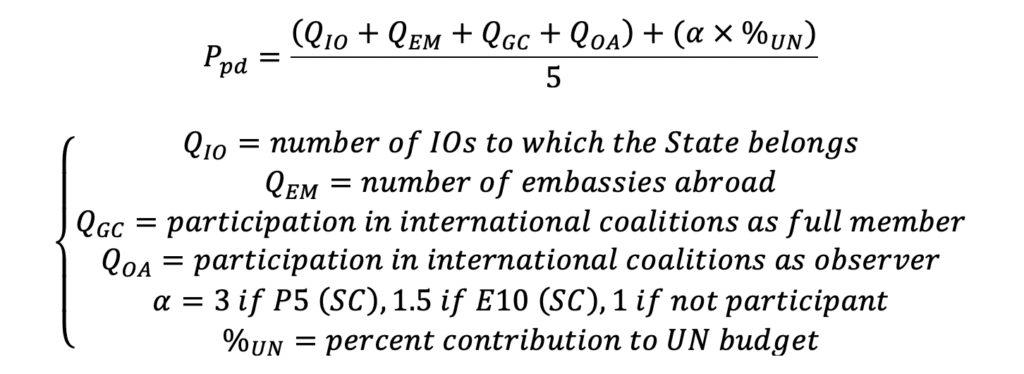

The five sub-indexes of the PI capture their respective dimension of state power through a combination of measurable indicators. For instance, the political and diplomatic power sub-index combines some quantitative measures of this dimension of national influence, such as the percent contribution of the State towards the budget of the United Nations. The example can be found in the photo below.

Following the construction of the sub-indexes, they are combined using a normalisation procedure, for the final value to lie in the range between 0 and 1. The methodology applied by Professor Castro is quite similar to the one we use for our Geopolitical Risk Index. Check it out!

This multidimensional approach, Castro argues, helps explain how companies react to the “hegemonic cycles” of rising and declining powers. When states project new power abroad, their private sectors often follow, attempting to expand into markets with state backing. China’s Belt and Road Initiative, for instance, has been accompanied by an expansion of Chinese private investment in Africa and Southeast Asia, often shielded by Beijing’s diplomatic umbrella.

The handshake, the sword, and the secret

In one of the more evocative moments of our conversation, Castro described diplomacy, military power, and intelligence through a symbolic trinomial: the handshake, the sword, and the secret. Diplomacy, he explains, is the handshake that builds consensus. Military might is the sword that compels through force. Intelligence is the secret that enables foresight.

CogniTrends, he says, was founded on the handshake and the secret. It is in these two pillars that Castro sees the most valuable contributions to the private sector.

What leaders need to survive the next decade

Looking ahead, Castro is blunt about the skills CEOs will need to thrive: open-mindedness, critical thinking, and a readiness to integrate international relations into core strategy. “A geopolitical risk that has not been planned or envisioned,” he warns, “can destroy companies. It can wipe out market share and trigger unemployment across entire sectors.”

In short, the message is clear: geopolitical risk is no longer an externality. It is a central variable of business survival. Make sure to watch the full interview on our YouTube channel to learn even more about geopolitical risk analysis and how companies such as CogniTrends are working in this field.